Annual sales: €539 million (up 2.2% at constant exchange rates and up 1.9%. on a reported basis)

Annual sales of Essential products: €328 million (up 4.6% at constant exchange rates and on a reported basis)

Matthieu Frechin, Chairman and CEO of Vetoquinol, commented: "All our activities and territories are growing, with the exception of the United States for one-off reasons. We are on track to deliver long-term profitable growth. We owe this to our focus strategy and the power of our "Essentials" model, which has delivered average annual growth of over 8% for the past 10 years. We will continue to pursue this strategy in 2025."

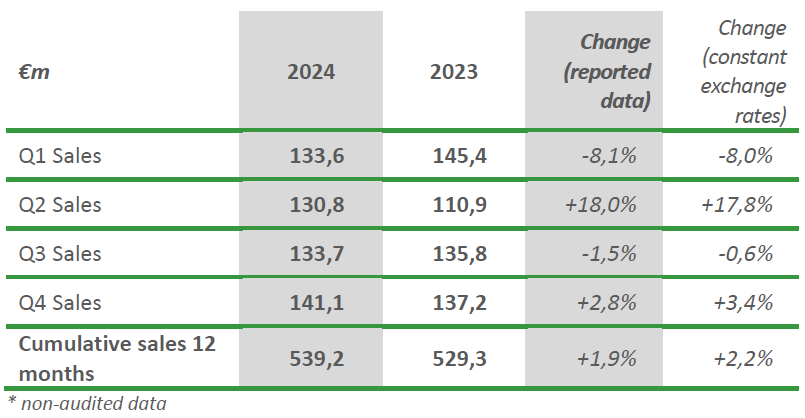

Vetoquinol's sales for FY 2024 came to €539 million, up 1.9 % on a reported basis and 2.2% at constant exchange rates.

Exchange rates had a negative impact of -€1.9 million.

Sales for the 4th quarter totaled €141 million, up 2.8% on a reported basis and up 3.4% at constant exchange rates, driven by sustained growth in Europe, and in the Americas including the United States.

The simplification of the portfolio of complementary products had a negative impact on annual sales of around -€8 million for the year, or around -1.5% of sales.

Sales of Essential products totaled €328 million, up 4.6 % on a reported basis and at constant exchange rates. These products, the key drivers of the Group's strategy, confirmed their solid growth momentum. However, this figure does not reflect their real performance given the unavailability in the 1st half-year of one of the main Essentials product ranges in the United States, which had an impact of around -1.5% on Essentials growth in 2024. Since the launch of this strategy in 2014, Essentials sales have more than doubled from €151 million in 2014 to €328 million in 2024, representing an average annual growth of over 8%. They now account for 61% of Group sales. In addition to their growth profile, these products are more profitable than complementary products.

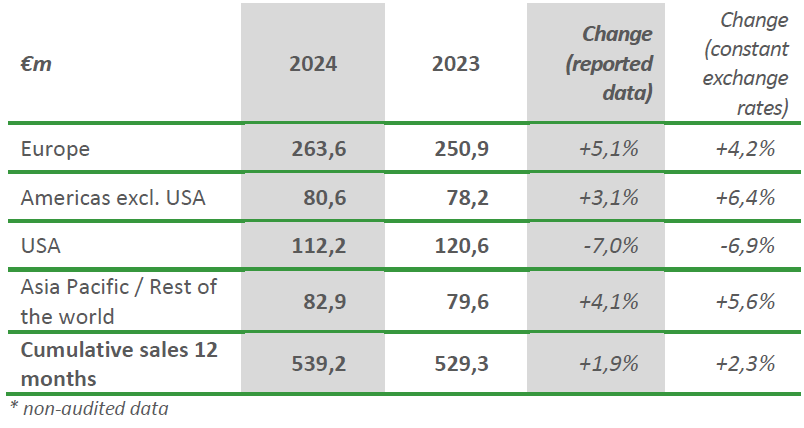

Geographically, growth was reported in Europe (+5.1%), Asia Pacific/Rest of World (+4.1%) and the Americas excluding the United States (+3.1%).

In Europe, the Group's largest market accounting for nearly 50% of sales, turned in a solid performance, driven by Essential products and the ongoing launch of Felpreva®.

The United States were down 6.9% at constant exchange rates. Two factors explain this trend. First, the market was disrupted by short-term arbitrages by local distributors at the end of the first half. Second, sales were affected by the unavailability of one of the main Essential product ranges in the 1st half of the year, due to a subcontracting problem. A solution was found, but due to the intense competition in this market, the return to normal happened gradually through the end of the year. The drop in business recorded in 2024 is therefore a one-off and does not call into question the strategic importance of the United States for the Group. Over the long term, it will remain the Group's 1st market, notably because of the potential it offers for the development of Essentials, which currently account for just over 40% of sales in the United States.

Sales of products for companion animals (€378 million) rose by 2% at constant exchange rates accounting for 70% of the laboratory's total sales. Sales to farm animals came to €162 million, up 2.8% at constant exchange rates.

Full-year sales for 2024 have not been audited by the Statutory Auditors.

Next publication: Annual results 2024, March 20, 2025 after market close.

ABOUT VETOQUINOL

Vetoquinol is a leading international player in animal health, with operations in Europe, the Americas and Asia/Pacific.

Independent and a pure player, Vetoquinol innovates, develops and markets veterinary medicines and non-medicated products for farm animals (cattle, pigs) and pets (dogs, cats).

Since its creation in 1933, Vetoquinol has combined innovation and geographic diversification. The strengthening of the product portfolio and acquisitions in high-potential territories ensure hybrid growth for the Group. At December 31 2024, Vetoquinol employed 2501 people.

Vetoquinol has been listed on Euronext Paris since 2006 (mnemonic code: VETO).

The Vetoquinol share is eligible for the French PEA and PEA-PME personal equity plans.

APPENDIX

Sales by quarter

Sales by strategic territory

ALTERNATIVE PERFORMANCE INDICATORS

Vetoquinol Group management believes that these non-IFRS indicators provide additional information that is relevant to shareholders in their analysis of the Group's underlying trends, performance and financial position. These indicators are used by management to analyze performance.

Essential products: Essential products are veterinary medicines and non-medicinal products marketed by the Vetoquinol Group. These are leading products, or products with the potential to become leaders, which meet the day-to-day needs of veterinarians in the farm animal and companion animal segments. These products are destined to be marketed worldwide, thus leveraging their economic performance.

Constant exchange rates: The term "constant exchange rate" refers to the application of the previous period's exchange rates to the current year, all other things being equal.

Organic growth: Organic growth refers to growth in Vetoquinol's sales due to an increase in sales volume and/or prices in year N compared with year N-1, at constant exchange rates and scope of consolidation.

Latest news

Nathalie Arlecchini appointed as Group Human Resources Director

April 2025

March 2025